Wednesday, January 16, 2008

What Is: Cloud Computing

Cloud computing

From Wikipedia, the free encyclopedia

Cloud computing is a computing paradigm shift where computing is moved away from personal computers or an individual application server to a “cloud” of computers. Users of the cloud only need to be concerned with the computing service being asked for, as the underlying details of how it is achieved are hidden. This method of distributed computing is done through pooling all computer resources together and being managed by software rather than a human.

The services being requested of a cloud are not limited to using web applications, but can also be IT management tasks such as requesting of systems, a software stack or a specific web appliance.

This simplifies IT management as well as increases efficiencies of system resources. IT administrators no longer need to install software and manually setup all the systems, but instead they have management software do this. Resources are used more efficiently as computers can be consolidated to be used for more tasks. This ensures underutilized systems do not sit idle.

Architecture

The architecture behind cloud computing is a massive network of "cloud servers" interconnected as if in a grid running in parallel, sometimes using the technique of virtualization to maximize computing power per server.

It is made up of a front-end interface which allows a user to select a service from a catalog. This request gets passed to the system management which finds the correct resources, and then calls the provisioning services which carves out resources in the cloud. The provisioning service may deploy the requested stack or web application as well.

User Interaction Interface: This is how users of the cloud interface with the cloud to request services.

Services Catalog: This is the list of services which a user could request.

System Management: This is the piece which manages the computer resources available.

Provisioning Tool: This tool carves out the systems from the cloud to deliver on the requested service. It may also deploy the required images.

Monitoring & Metering: This optional piece tracks the usage of the cloud so the resources used can be attributed to a certain user.

Servers: The servers get managed by the system management tool. They can be either virtual or real.

Tuesday, January 15, 2008

Why Henry Sy Believes the Philippines is not Hopeless

By Wilson Lee Flores

"I am optimistic that we can achieve a better future. It is not true that the Philippines is a hopeless case," 82-year-old SM Group and Banco de Oro founder Henry Sy recently told The Philippine STAR. "I am an immigrant who came here at 12 years old, spoke no English or Tagalog, but I came to appreciate the natural beauty and many economic advantages of the

Philippines more than many other people do, and I kept working and

investing with positive thinking."

The exclusive three-hour interview took place at his simple but elegant bungalow in North Forbes Park, Makati City, and at Tanabe Japanese Restaurant in his SM Mall of Asia in Pasay City.

In the over two decades I have known the legendary rags-to-riches taipan and shopping-mall pioneer, Henry Sy has become more mentally sharp and energetic than ever before. He is strong despite his weak knees, which occasionally forced him to use the wheelchair when we briefly toured his newest pride and passion at the SM Mall of Asia.

PHILIPPINE STAR: Congratulations on the success of the SM Mall of Asia. What did your competitors say about your biggest shopping-mall project yet?

HENRY SY: I called Robinsons mall boss John Gokongwei Jr to personally invite him to the blessing of the SM Mall of Asia, but he said he couldn't make it. Even though we are competitors, I do not think Gokongwei has any complaints about me.

Your executives tell me that one million people came to the SM Mall of Asia on your first day, May 21, then 400,000 came the next day, Monday. Why are people coming here, when this location is not along a highway like SM Megamall or at a crossroads like SM North Edsa?

A lot of the customers to this mall came from the provinces and they enjoy touring the place. It is not only constructing the place that creates a good mall, we at SM create destinations using continuous research, studies and new ideas to match the needs and wants of the people. Doing a mall is not only construction of the physical place, what's important is the merchandising mix. We strive to serve the convenience of the public. We want shopping at our malls to be a unique and an enjoyable experience.

Why did you build an Olympic-size ice-skating rink in this mall?

Very few people know this: I love skating and bowling. I used to roller skate a lot in my youth on Taft Avenue, Manila. That's the reason why there's always a skating area in all my SM malls. I want more people to share my love for skating.

When you were a kid, what was your original ambition?

I have always wanted to be a businessman. No other ambitions, I just wanted to be in business, even when I was a child in Fujian province, south China.

Why did you invest P7 billion in Mall of Asia's 500 outlets, 180 restaurants and other facilities, at a time when the Philippine economy is not that strong?

It's investment that manifests my strong confidence in the Philippine future. I hope this biggest mall project will have a positive impact on the Philippine economy and I hope to encourage other business people to invest, too. Not everything I do is purely for money. Of course, as a businessman and as head of publicly listed companies, we have to earn, but at this point

in my life, there are other considerations more important besides just money. I took a risk and invested in SM Mall of Asia because I wanted to create something that could contribute to Philippine tourism growth. If I am only after profits, the easiest way is for me t o construct high-rise condominiums here along the seashore facing Manila Bay, or I could just develop high-end subdivisions here and subdivide the lots to cash in quickly with big profits. But constructing this mall is a long-term investment; it is proof of my faith in the future of the Philippine economy. I wanted to build a beautiful destination for shopping, wholesome family-oriented entertainment and leisure. That church outside this mall, I donated it to everything from the structure, the land, to the interior furnishings and decor and it's not for profit.

What else do you wish to achieve after the SM Mall of Asia? What other big projects can we expect from you?

My biggest wish is for government, the private sector and all of us to work together to make the Philippines the best tourism destination in Southeast Asia. This is the reason I am always optimistic that the Philippines is not a hopeless case, contrary to what a lot of cynics claim. What Thailand can offer in tourism places and services, we in the Philippines can match, except for our past reputation in peace-and-order problems. That's what has held back our tourism growth. Philippine economic prospects are very good; we just have some problems in the investment environment which the government is now rectifying. Other export industries often rely on

imported raw materials and the Philippines often only earns the labor input, but in the tourism industry, the Philippines can earn as much as 80 percent for every dollar spent here on food, shopping, entertainment, hotels, transport, etc., while 20 percent probably goes to imported liquor and other luxury goods. I am into tourism with Tagaytay Highlands, Taal Vista Hotel. We shall keep investing in new tourist-friendly malls, we are now master-planning a new 5,700-hectare seaside tourism project called Hamilo Coastal in Batangas, and many others.

Why do you think the Philippines is ideal for tourism?

First, there's the location: we are just two to three hours from all the major Asian cities like Singapore, Malaysia, China, Hong Kong, Taiwan and others. Second, our people are famous for the best service in Southeast Asia. Third, people here are proficient in English. Fourth, the Philippines has many naturally beautiful tourist destinations, beaches, thousands of

islands, unique flora and fauna, vast fishery resources, and others. Fifth, the Philippines is excellent in entertainment, which is important in tourism. Look at the singers and bands in top hotels, from Shanghai to Seoul to Tokyo, many of them are Filipino entertainers. Sixth, you do not need much capital or foreign investments for tourism development. Seventh, Philippine hospitality is better than others in ASEAN culture just look at the people's smiling faces. In our Chinese language, we call this "ho khe chieng", or people who are warm and hospitable in welcoming clients and guests. There are many more advantages. I could spend all day and all night talking to you about the tourism potentials of this country.

What are your suggestions on how to build up Philippine tourism?

I have a very simple formula based on common sense that will help accelerate Philippine tourism growth: the government should improve the peace-and-order situation as well as the international image of the Philippines on this crucial issue. The government should upgrade infrastructure, there should be a strong information campaign worldwide to promote the Philippines as an ideal tourism destination. In a recent event of HSBC, a TV talk show host of CNN asked for my advice to politicians and I shared only a few words of advice: work more, talk less. Government every year claims over two million tourist arrivals.

What do you think should be the ideal number of tourists coming to the Philippines annually?

Our target should first be to attract five million tourists in the first five years, then go for over 10 million in 10 years. Every time I meet President Gloria Macapagal Arroyo, I always tell her this dream of mine and my excitement about Philippine tourism potentials because I know she really wants a better Philippine economy.

In this era of globalization, SM is also going international like the western multinationals Walmart, Carrefour, Metro and others.

What are your plans in China?

We have four major projects in China. In August or September this year, we shall inaugurate our new mall in Chengdu City, the capital of the 100-million- people Sichuan province. China is a dynamic place, it is amazing in progress.

Why is it that your children did not grow up spoiled, and seem to have imbibed your work ethic and business acumen?

How did you train them?

I think it's their innate natural drive. I also trained them in the importance of hard work. Even while they were in high school, my children used to spend their free time working at our SM Department Store in Makati.

Who among your six children like Tessie, Elizabeth, Henry Jr., Hans, Herbert and Harley will become your future successor and the leader of the SM Groups next generation?

I cannot for now ascertain who will be the leader. We are organized as corporations, publicly listed firms. Whoever becomes the leader of the next generation shall rise based on merits and abilities. Unlike other top Chinese business families in Asia, which favor male sons over daughters, all my six children are treated equally. My eldest child Tessie is hardworking and very capable; it doesn't matter that she's a woman. She always wants to learn and she is a fast learner.

A billionaire asked me recently who is richer, you or Lucio Tan?

How can I know for sure who is bigger in net worth when each person has his own strengths that not everyone fully appreciates? I don't like to say this guy is the biggest in wealth, because some people have wealth which is hidden and isn't that a fair point of view?

John Gokongwei Jr. told me that when he first applied for a loan with PBCom it was not approved, and it was China Bank's Dee K. Chiong and Dr. Albino SyCip who approved his first loan of P500,000 in 1950.

What about your first loan?

I don't usually like to get loans. In fact, the reason why we did well and completed our first mall project, SM North Edsa, even after the 1983 economic crisis and after the Ninoy Aquino assassination, was because we had very little loans then. I got my first credit line in 1949, it was from China Bank and they lent me P1 million. My credit line was approved by Mr. Yap Tian Siang in their head office before at Juan Luna Street, corner Dasmarinas Street.

Did you ever imagine in 1949 that you would someday own more than 70 percent of China Bank, and that you would have Banco de Oro and soon, possibly, Equitable PCIBank?

No, I never imagined then that I would own banks. You know, despite our many shareholdings in China Bank, the Dee family of the original founder has managed the institution so professionally and profitably, we never attempted to change the incumbent chairman Gilbert Dee or president Peter Dee. We are not that greedy, it's not good. I don't believe in wanting both power and financial gain. Even those executives who have been with China Bank for many years, they are still there. If a venerable institution like China Bank is doing so well, why make changes?

Is it true you already own 11 percent of San Miguel Corporation?

I have invested a lot in that well-managed company, but I do not want to mention figures.

What are the business principles or strategies that made you successful?

I would not classify this as a secret to success, but one of my lifelong practices is to pay my obligations on time, especially my suppliers. Even in my early years as retailer, I didn't delay my payments to suppliers, because I tell my kids that we have to be considerate to suppliers and think of their own "hinyong" or how they have to protect their sense of trustworthiness with others. If it's time to pay others on Monday, we would already deposit the money in their bank accounts on Friday, so they need not even come to our office to collect.

Your SM Cinemas do not allow R-18 or For Adults Only movies, including The Da Vinci Code. Are you a Catholic or is it just your wife?

I am Catholic, but yes, it's my wife Felicidad Tan Sy who is the most devout among us in the family. She devotes almost all her time and money to the Catholic Church.

Your SM Group leases out or has retail businesses in millions of square meters of prime commercial space. When you came to the Philippines as a 12-year-old boy, how big was the sari-sari store of your father and what was its name?

It was a small "ha-ya-tiam" , it had no name. It was located on Echague St., which is now Carlos Palanca Sr. St. in Quiapo, Manila. It was only about 30 square meters in floor area.

Why did you cry when you first saw your father in his store?

I cried because I saw how hard the life of my father was as a small shopkeeper. He worked from early morning to late at night every day.. He would go to "chay-chi-khaw" area or Divisoria to buy goods, carrying them himself on his back in order to resell in the store. I learned the importance of honest hard work, frugality and discipline from his example.

Where did you and your father sleep at night, on the second floor or at the back of the store?

Our sari-sari store was so small it had no back or second floor, we just slept on the counter late at night after the store was closed.

When you were a kid and you saw your father struggling with his sari-sari store, did that motivate you to aspire to become Southeast Asia's Shopping Mall King?

As a kid, I had the will to strive for excellence and to overcome the hard environment, but I never imagined attaining big success. Whatever I have achieved did not happen overnight; ever since my teen years I have devoted many, many years of my life to non-stop studying, diligent work and dreaming of a better future.

Speech: John Gokongwei , Jr. at Ad Congress

Nov 21, 2007

Before I begin, I want to say please bear with me, an 81-year-old man who just flew in from San Francisco 36 hours ago and is still suffering from jet lag. However, I hope I will be able to say what you want to hear…

Ladies and gentlemen, good evening. Thank you very much for having me here tonight to open the Ad Congress. I know how important this event is for our marketing and advertising colleagues. My people get very excited and go into a panic, every other year, at this time.

I would like to talk about my life, entrepreneurship, and globalization. I would like to talk about how we can become a great nation.

You may wonder how one is connected to the other, but I promise that, as there is truth in advertising, the connection will come.

Let me begin with a story I have told many times. My own.

I was born to a rich Chinese-Filipino family. I spent my childhood in Cebu where my father owned a chain of movie houses, including the first air-conditioned one outside Manila. I was the eldest of six children and lived in a big house in Cebu's Forbes Park.

A chauffeur drove me to school everyday as I went to San Carlos University, then and still one of the country's top schools. I topped my classes and had many friends. I would bring them to watch movies for free at my father's movie houses.

When I was 13, my father died suddenly of complications due to typhoid. Everything I enjoyed vanished instantly. My father's empire was built on credit. When he died, we lost everything—our big house, our cars, our business—to the banks.

I felt angry at the world for taking away my father, and for taking away all that I enjoyed before. When the free movies disappeared, I also lost half my friends. On the day I had to walk two miles to school for the very first time, I cried to my mother, a widow at 32. But she said: "You should feel lucky. Some people have no shoes to walk to school. What can you do? Your father died with 10 centavos in his pocket."

So, what can I do? I worked.

My mother sent my siblings to China where living standards were lower. She and I stayed in Cebu to work, and we sent them money regularly. My mother sold her jewelry. When that ran out, we sold roasted peanuts in the backyard of our much-smaller home. When that wasn't enough, I opened a small stall in a palengke.

I chose one among several palengkes a few miles outside the city because there were fewer goods available for the people there. I woke up at five o'clock every morning for the long bicycle ride to the palengke with my basket of goods.

There, I set up a table about three feet by two feet in size. I laid out my goods—soap, candles, and thread—and kept selling until everything was bought. Why these goods? Because these were hard times and this was a poor village, so people wanted and needed the basics—soap to keep them clean, candles to light the night, and thread to sew their clothes.

I was surrounded by other vendors, all of them much older. Many of them could be my grandparents. And they knew the ways of the palengke far more than a boy of 15, especially one who had never worked before.

But being young had its advantages. I did not tire as easily, and I moved more quickly. I was also more aggressive. After each day, I would make about 20 pesos in profit! There was enough to feed my siblings and still enough to pour back into the business. The pesos I made in the palengke were the pesos that went into building the business I have today .

After this experience, I told myself, " If I can compete with people so much older than me, if I can support my whole family at 15, I can do anything!"

Looking back, I wonder, what would have happened if my father had not left my family with nothing? Would I have become the man I am? Who knows?

The important thing to know is that life will always deal us a few bad cards. But we have to play those cards the best we can. And WE can play to win!

This was one lesson I picked up when I was a teenager. It has been my guiding principle ever since. And I have had 66 years to practice self-determination. When I wanted something, the best person to depend on was myself.

And so I continued to work. In 1943, I expanded and began trading goods between Cebu and Manila. From Cebu, I would transport tires on a small boat called a batel. After traveling for five days to Lucena, I would load them into a truck for the six- hour trip to Manila. I would end up sitting on top of my goods so they would not be stolen! In Manila, I would then purchase other goods from the earnings I made from the tires, to sell in Cebu.

Then, when WWII ended, I saw the opportunity for trading goods in post-war Philippines. I was 20 years old. With my brother Henry, I put up Amasia Trading which imported onions, flour, used clothing, old newspapers and magazines, and fruits from the United States. In 1948, my mother and I got my siblings back from China. I also converted a two-story building in Cebu to serve as our home, office, and warehouse all at the same time. The whole family began helping out with the business .

In 1957, at age 31, I spotted an opportunity in corn-starch manufacturing. But I was going to compete with Ludo and Luym, the richest group in Cebu and the biggest cornstarch manufacturers. I borrowed money to finance the project. The first bank I approached made me wait for two hours, only to refuse my loan. The second one, China Bank, approved a P500,000-peso clean loan for me. Years later, the banker who extended that loan, Dr. Albino Sycip said that he saw something special in me. Today, I still wonder what that was, but I still thank Dr. Sycip to this day.

Upon launching our first product, Panda corn starch , a price war ensued. After the smoke cleared, Universal Corn Products was still left standing. It is the foundation upon which JG Summit Holdings now stands.

Interestingly, the price war also forced the closure of a third cornstarch company, and one of their chemists was Lucio Tan, who always kids me that I caused him to lose his job. I always reply that if it were not for me, he will not be one of the richest men in the Philippines today.

When my business grew, and it was time for me to bring in more people—my family, the professionals, the consultants, more employees—I knew that I had to be there to teach them what I knew. When dad died at age 34, he did not leave a succession plan. From that, I learned that one must teach people to take over a business at any time. The values of hard work that I learned from my father, I taught to my children. They started doing jobs here and there even when they were still in high school. Six years ago, I announced my retirement and handed the reins to my youngest brother James and only son Lance. But my children tease me because I still go to the office every day and make myself useful. I just hired my first Executive Assistant and moved into a bigger and nicer office.

Building a business to the size of JG Summit was not easy. Many challenges were thrown my way. I could have walked away from them, keeping the business small, but safe. Instead, I chose to fight. But this did not mean I won each time.

By 1976, at age 50, we had built significant businesses in food products anchored by a branded coffee called Blend 45, and agro-industrial products under the Robina Farms brand. That year, I faced one of my biggest challenges, and lost. And my loss was highly publicized, too. But I still believe that this was one of my defining moments.

In that decade, not many business opportunities were available due to the political and economic environment. Many Filipinos were already sending their money out of the country. As a Filipino, I felt that our money must be invested here. I decided to purchase shares in San Miguel, then one of the Philippines' biggest corporations. By 1976, I had acquired enough shares to sit on its board.

The media called me an upstart. " Who is Gokongwei and why is he doing all those terrible things to San Miguel?" ran one headline of the day. In another article, I was described as a pygmy going up against the powers-that-

On the day of reckoning, shareholders quickly filled up the auditorium to witness the battle. My brother James and I had prepared for many hours for this debate. We were nervous and excited at the same time.

In the end, I did not get the board seat because of the Supreme Court Ruling. But I was able to prove to others—and to myself—that I was willing to put up a fight. I succeeded because I overcame my fear, and tried. I believe this battle helped define who I am today. In a twist to this story, I was invited to sit on the board of Anscor and San Miguel Hong Kong 5 years later. Lose some, win some.

Since then, I've become known as a serious player in the business world, but the challenges haven't stopped coming.

Let me tell you about the three most recent challenges. In all three, conventional wisdom bet against us. See, we set up businesses against market Goliaths in very high-capital industries: airline, telecoms, and beverage.

Challenge No. 1 : In 1996, we decided to start an airline. At the time, the dominant airline in the country was PAL, and if you wanted to travel cheaply, you did not fly. You went by sea or by land.

However, my son Lance and I had a vision for Cebu Pacific: We wanted every Filipino to fly.

Inspired by the low-cost carrier models in the United States, we believed that an airline based on the no-frills concept would work here. No hot meals. No newspaper. Mono-class seating. Operating with a single aircraft type. Faster turn around time. It all worked, thus enabling Cebu Pacific to pass on savings to the consumer.

How did we do this? By sticking to our philosophy of "low cost, great value ."

And we stick to that philosophy to this day. Cebu Pacific offers incentives. Customers can avail themselves of a tiered pricing scheme, with promotional seats for as low a P1. The earlier you book, the cheaper your ticket.

Cebu Pacific also made it convenient for passengers by making online booking available. This year, 1.25 million flights will be booked through our website. This reduced our distribution costs dramatically.

Low cost. Great value.

When we started 11 years ago, Cebu Pacific flew only 360,000 passengers, with 24 daily flights to 3 destinations. This year, we expect to fly more than five million passengers, with over 120 daily flights to 20 local destinations and 12 Asian cities. Today, we are the largest in terms of domestic flights, routes and destinations.

We also have the youngest fleet in the region after acquiring new Airbus 319s and 320s. In January, new ATR planes will arrive. These are smaller planes that can land on smaller air strips like those in Palawan and Caticlan. Now you don't have to take a two-hour ride by mini-bus to get to the beach.

Largely because of Cebu Pacific, the average Filipino can now afford to fly. In 2005, 1 out of 12 Filipinos flew within a year. In 2012, by continuing to offer low fares, we hope to reduce that ratio to 1 out of 6. We want to see more and more Filipinos see their country and the world!

Challenge No. 2: In 2003, we established Digitel Mobile Philippines, Inc. and developed a brand for the mobile phone business called Sun Cellular. Prior to the launch of the brand, we were actually involved in a transaction to purchase PLDT shares of the majority shareholder.

The question in everyone's mind was how we could measure up to the two telecom giants. They were entrenched and we were late by eight years! PLDT held the landline monopoly for quite a while, and was first in the mobile phone industry. Globe was a younger company, but it launched digital mobile technology here.

But being a late player had its advantages. We could now build our platform from a broader perspective. We worked with more advanced technologies and intelligent systems not available ten years ago. We chose our suppliers based on the most cost-efficient hardware and software. Being a Johnny-come-

All these provided us with the opportunity to give the consumers a choice that would rock their world. The concept was simple. We would offer Filipinos to call and text as much as they want for a fixed monthly fee. For P250 a month, they could get in touch with anyone within the Sun network at any time. This means great savings of as much as 2/3 of their regular phone bill! Suddenly, we gained traction. Within one year of its introduction, Sun hit one million customers.

Once again, the paradigm shifts - this time in the telecom industry. Sun's 24/7 Call and Text unlimited changed the landscape of mobile-phone usage.

Today, we have over 4 million subscribers and 2000 cell sites around the archipelago. In a country where 97% of the market is pre-paid, we believe we have hit on the right strategy.

Sun Cellular is a Johnny-come-

In the end, it is all about making life better for the consumer by giving them choices.

Challenge No. 3: In 2004, we launched C2, the green tea drink that would change the face of the local beverage industry -- then, a playground of cola companies. Iced tea was just a sugary brown drink served bottomless in restaurants. For many years, hardly was there any significant product innovation in the beverage business.

Admittedly, we had little experience in this area. Universal Robina Corporation is the leader in snack foods but our only background in beverage was instant coffee. Moreover, we would be entering the playground of huge multinationals. We decided to play anyway.

It all began when I was in China in 2003 and noticed the immense popularity of bottled iced tea. I thought that this product would have huge potential here. We knew that the Philippines was not a traditional tea-drinking country since more familiar to consumers were colas in returnable glass bottles. But precisely, this made the market ready for a different kind of beverage. One that refreshes yet gives the health benefits of green tea. We positioned it as a "spa" in a bottle. A drink that cools and cleans…thus, C2 was born.

C2 immediately caught on with consumers. When we launched C2 in 2004, we sold 100,000 bottles in the first month. Three years later, Filipinos drink around 30 million bottles of C2 per month. Indeed, C2 is in a good place.

With Cebu Pacific, Sun Cellular, and C2, the JG Summit team took control of its destiny. And we did so in industries where old giants had set the rules of the game. It's not that we did not fear the giants. We knew we could have been crushed at the word go. So we just made sure we came prepared with great products and great strategies. We ended up changing the rules of the game instead.

There goes the principle of self-determination, again. I tell you, it works for individuals as it does for companies. And as I firmly believe, it works for nations.

I have always wondered, like many of us, why we Filipinos have not lived up to our potential. We have proven we can. Manny Pacquiao and Efren Bata Reyes in sports. Lea Salonga and the UP Madrigal Singers in performing arts. Monique Lhuillier and Rafe Totenco in fashion. And these are just the names made famous by the media. There are many more who may not be celebrities but who have gained respect on the world stage.

But to be a truly great nation, we must also excel as entrepreneurs before the world. We must create Filipino brands for the global market place.

If we want to be philosophical, we can say that, with a world-class brand, we create pride for our nation. If we want to be practical, we can say that, with brands that succeed in the world, we create more jobs for our people, right here.

Then, we are able to take part in what's really important—giving our people a big opportunity to raise their standards of living, giving them a real chance to improve their lives.

We can do it. Our neighbors have done it. So can we.

In the last 54 years, Korea worked hard to rebuild itself after a world war and a civil war destroyed it. From an agricultural economy in 1945, it shifted to light industry, consumer products, and heavy industry in the '80s. At the turn of the 21 st century, the Korean government focused on making Korea the world's leading IT nation. It did this by grabbing market share in key sectors like semiconductors, robotics, and biotechnology.

Today, one remarkable Korean brand has made it to the list of Top 100 Global Brands: Samsung. Less then a decade ago, Samsung meant nothing to consumers. By focusing on quality, design, and innovation, Samsung improved its products and its image. Today, it has surpassed the Japanese brand Sony. Now another Korean brand, LG Collins, is following in the footsteps of Samsung. It has also broken into the Top 100 Global Brands list.

What about China? Who would have thought that only 30 years after opening itself up to a market economy, China would become the world's fourth largest economy? Goods made in China are still thought of as cheap. Yet many brands around the world outsource their manufacturing to this country. China's own brands—like Lenovo, Haier, Chery QQ, and Huawei—are fast gaining ground as well. I have no doubt they will be the next big electronics, technology and car brands in the world.

Lee Kwan Yu's book "From Third World to First" captures Singapore's aspiration to join the First World. According to the book, Singapore was a trading post that the British developed as a nodal point in its maritime empire. The racial riots there made its officials determined to build a "multiracial society that would give equality to all citizens, regardless of race, language or religion."

When Singapore was asked to leave the Malaysian Federation of States in 1965, Lee Kwan Yew developed strategies that he executed with single-mindedness despite their being unpopular. He and his cabinet started to build a nation by establishing the basics: building infrastructure, establishing an army, weeding out corruption, providing mass housing, building a financial center. Forty short years after, Singapore has been transformed into the richest South East Asian country today, with a per capita income of US$32,000.

These days, Singapore is transforming itself once more. This time it wants to be the creative hub in Asia, maybe even the world. More and more, it is attracting the best minds from all over the world in filmmaking, biotechnology, media, and finance. Meantime, Singaporeans have also created world-class brands: Banyan Tree in the hospitality industry, Singapore Airlines in the Airline industry and Singapore Telecoms in the telco industry.

I often wonder: Why can't the Philippines, or a Filipino, do this?

Fifty years after independence, we have yet to create a truly global brand. We cannot say the Philippines is too small because it has 86 million people. Switzerland, with 9 million people, created Nestle. Sweden, also with 9 million people, created Ericsson . Finland, even smaller with five million people, created Nokia. All three are major global brands, among others.

Yes, our country is well-known for its labor, as we continue to export people around the world. And after India, we are grabbing a bigger chunk of the pie in the call-center and business-process-

We should not be afraid to try—even if we are laughed at. Japan, laughed at for its cars, produced Toyota. Korea, for its electronics, produced Samsung. Meanwhile, the Philippines' biggest companies 50 years ago—majority of which are multinational corporations such as Coca-Cola, Procter and Gamble, and Unilever Philippines, for example—are still the biggest companies today. There are very few big, local challengers.

But already, hats off to Filipino entrepreneurs making strides to globalize their brands.

Goldilocks has had much success in the Unites States and Canada, where half of its customers are non-Filipinos. Coffee-chain Figaro may be a small player in the coffee world today, but it is making the leap to the big time. Two Filipinas, Bea Valdez and Tina Ocampo , are now selling their Philippine-made jewelry and bags all over the world. Their labels are now at Barney's and Bergdorf's in the U.S. and in many other high-end shops in Asia, Europe, and the Middle East.

When we started our own foray outside the Philippines 30 years ago, it wasn't a walk in the park. We set up a small factory in Hong Kong to manufacture Jack and Jill potato chips there. Today, we are all over Asia. We have the number-one-potato-

I am 81 today. But I do not forget the little boy that I was in the palengke in Cebu. I still believe in family. I still want to make good. I still don't mind going up against those older and better than me. I still believe hard work will not fail me. And I still believe in people willing to think the same way.

Through the years, the market place has expanded: between cities, between countries, between continents. I want to urge you all here to think bigger. Why serve 86 million when you can sell to four billion Asians? And that's just to start you off. Because there is still the world beyond Asia. When you go back to your offices, think of ways to sell and market your products and services to the world. Create world-class brands.

You can if you really tried. I did. As a boy, I sold peanuts from my backyard. Today, I sell snacks to the world.

I want to see other Filipinos do the same.

Thank you and good evening once again.

-- Shared by Armando B. Aspiras

Sunday, January 13, 2008

Website: Veoh.com

Veoh is a Web site that's headed for your TV. It's also the name for a suite of applications for collecting, publishing, and watching a vast selection of video programming. Veoh is a diverse, virtual community of indie publishers coming together with their new audiences. And it's also a few offices in Southern California full of entertainment industry insiders, outsiders, and technologists.

This is how we see it. Television sent the old neighborhood cinema audience back to their homes, where they were told what to watch, and when.

Let's set them free again. Bring them back together and give them what they've wanted all along. Veoh gives viewers a limitless marketplace of compelling or informative television programming for wherever and whenever they choose to watch.

VeohTV and Veoh.com combine as a virtual television network that organizes, showcases, and delivers clear, full-screen video programming to anyone with a broadband connection. VeohTV turns online video into Internet television.

With VeohTV, watch video from thousands of websites, in one easy-to-use full screen application. Watch streaming video from major television networks such as CBS, to independently-produced content available on sites such as YouTube, Google Video, Veoh.com and MySpace. Navigate with a keyboard and mouse or use a PC remote control. VeohTV is like a free DVR for web video. Watch video on-demand or record it to your hard drive to watch later.

Veoh.com is an advanced video hosting and sharing site with over 70,000 content publishers – from Lions Gate, PBS, National Lampoon, Road and Track and Us Magazine to thousands of independent filmmakers and content producers.

Filmmakers, producers, journalists, content owners - players at any level - can become independent publishers on Veoh. Uploaded once, a video project is syndicated everywhere, across nearly every major video-sharing/distribution site on the Web. Publishers may offer their segments anywhere for free or pay-per-view.

About the suits. Veoh Networks, Inc., is privately held and backed by leading technology and media investors, including Spark Capital, Michael Eisner's Tornante Company, Time Warner Inc. and Shelter Capital Partners.

Thursday, January 10, 2008

Wednesday, January 09, 2008

What Is: Financial Literacy

Financial literacy

International findings

An international OECD study was published in late 2005 analysing financial literacy surveys in OECD countries. A selection of findings[2] included:

- In Australia, 67 per cent of respondents indicated that they understood the concept of compound interest, yet when they were asked to solve a problem using the concept only 28 per cent had a good level of understanding.

- A British survey found that consumers do not actively seek out financial information. The information they do receive is acquired by chance, for example, by picking up a pamphlet at a bank or having a chance talk with a bank employee.

- A Canadian survey found that respondents considered choosing the right investments to be more stressful than going to the dentist.

- A survey of Korean high-school students showed that they had failing scores - that is, they answered fewer than 60 per cent of the questions correctly - on tests designed to measure their to choose and manage a credit card, their knowledge about saving and investing for retirement, and their awareness of risk and the importance of insuring against it.

- A survey in the US found that four out of ten American workers are not saving for retirement.

“Yet it is encouraging that the few financial education programmes which have been evaluated have been found to be reasonably effective. Research in the US shows that workers increase their participation in 401(k) plans (a type of retirement plan, with special tax advantages, which allows employees to save and invest for their own retirement) when employers offer financial education programmes, whether in the form of brochures or seminars.”

Financial literacy is the ability to make informed judgements and effective decisions about the use and management of money. It's an essential skill for functioning in modern society and is becoming increasingly important to the long-term wellbeing of individuals and the community.

http://www.anz.com/aus/aboutanz/Community/Programs/FinLit.asp

What Is: Financial Inclusion

Promoting financial inclusion

Over a million adults in Britain still live their lives without the most basic of financial products. Some 6-9 per cent of all households do not have any kind of bank or building society account and 14-23 per cent live without the flexibility of a current account. [Footnote 1] There is a large minority of people for whom the financial services revolution has effectively passed them by; they are financially excluded. Against this backdrop, Faith Reynolds assesses some current initiatives that are attempting to promote greater financial inclusion.

The reality of financial exclusion

Underpinning financial exclusion are problems of poverty, ignorance and environment:

- Poverty: being on a low income, especially out of work and on benefits.

- Ignorance: low levels of awareness and understanding of products caused by lack of appropriate marketing or low levels of financial literacy.

- Environment: lack of access to financial services caused by several factors, including:

- – geographic access to bank branches or remote banking facilities;

– affordability of products such as insurance, where premiums often price out those living in the most deprived and risky areas;

– suitability of products like current accounts, which offer an overdraft and an easy route to debt;

– regulatory barriers, such as the money laundering guidelines requiring proof of identification which many people find difficult to provide;

– cultural and psychological barriers, such as language, perceived/actual racism and suspicion or fear of financial institutions.

The implications of being financially excluded

Living without financial products is a significant disadvantage in an age where cash is slowly being replaced by debit cards and automated transactions, and living on credit is the norm. Having no insurance exacerbates the effects of theft. Outside of mainstream financial products, saving options are informal and unreliable. Discounts on utility bills for paying by direct debit are inaccessible. Affordable short-term credit is replaced by sub-prime lenders offering credit on APRs that often exceed 100 per cent, pawn brokers and loan sharks. Being financially excluded can cost and it is the most deprived who pay the price.

Toynbee Hall and SAFE: Services Against Financial Exclusion

Toynbee Hall is a voluntary organisation that was established in 1884 to alleviate poverty in the East End of London, an area with a history of deprivation. Toynbee Hall has a tradition of developing innovative services. Indeed, Child Poverty Action Group started at Toynbee Hall in 1965.[Footnote 2] A more recent addition is SAFE: Services Against Financial Exclusion. SAFE was launched in March 2002 and currently offers financial information and education, promotes access to basic bank accounts and to the Saving Gateway, a government pilot savings scheme. SAFE also works in partnership with Toynbee’s free legal advice service, The Environment Trust and Quaker Social Action to promote free debt advice and access to free training opportunities and micro-finance (through the Community Finance and Learning Initiative).

The problems underpinning financial exclusion are interlinked and need to be addressed jointly as well as individually. Financial inclusion is a key part of the Government’s social inclusion policy and it has applied pressure on its departments to review, reform and regulate where necessary. Others have taken up the baton, including various policy makers, the Financial Services Authority (whose job it is to promote public awareness of UK financial systems) and the voluntary sector. Some financial institutions have also made costly, if, in some cases, half-hearted steps towards promoting financial inclusion. ‘Joined-up doing’ (as well as thinking) is needed to ensure financial inclusion becomes reality.

There are many initiatives being established across the country with the aim of tackling financial exclusion. The following discussion highlights three common themes of these initiatives and some of their policy implications.

| The community Toynbee Hall serves There are a number of different factors which aggravate financial exlusion and which make residents vulnerable to financial (if not other) forms or exclusion: | |

| Being on a low income: | In 1999 over 60 per cent of households had a gross income of less than £10,000. |

| Being unemployed: | 11.8 per cent are out of work, compared with the national average of 3.8 per cent. |

| Suffering long-term illness or disbility: | 9.2 per cent of Tower Hamlets residents are in receipt of incapacity benefit, compared with 6.2 per cent for the UK. |

| Being in certain ethnic groups: | Nearly a quarter of the entire British Bangladeshi population live in Tower Hamlets. This group is the most deprived in the UK with 70 per cent in the bottom 20 per cent of the income range. |

| Living in areas of high deprivation: | The ward of Spitalfields is ranked 41st on the index of deprivation and st for housing deprivation. |

Asset-building and the Saving Gateway

The anti-poverty lobby and living wage campaign are well established. A more recent innovation is asset-based welfare policy. It is suggested that increasing an individual’s or community’s asset holding can increase social mobility and offer a positive route out of financial exclusion and poverty.[Footnote 3]

Raising income is part of the Government’s welfare policy and financial assets have a complementary role to play. [Footnote 4] Having money put aside smoothes peaks and troughs (and acts as an alternative to a short-term loan); it also allows people to take advantage of opportunities which might otherwise be denied (eg, paying for further education); in the longer term it can offer a more comfortable retirement. The act of saving reinforces longer-term thinking and a sense of responsibility for one’s future. Holding a savings product also reduces financial exclusion.

Research shows that people on lower incomes are least likely to save or hold assets.[Footnote 5] They are also unlikely to be affected by tax breaks, which might be attractive to people on higher incomes. The Saving Gateway is one policy the Government is piloting to encourage low-income households into saving. The scheme offers to match an individual’s savings, a pound for a pound up to a specified limit and is run through trusted community-based organisations, which act as intermediaries between the client and the delegated bank (the Halifax). Given the expense of the project and the target group, the Saving Gateway has caused much controversy.

One valid question raised by the Institute for Fiscal Studies [Footnote 6] is whether people on low incomes should be encouraged to save in the first place and incentivised with such high returns. Its work suggests that only one in eight of the poorest fifth of the population will benefit from the Saving Gateway in the way that the Government [Footnote 7] expects and that those left may indeed borrow to save into the scheme. Others argue that people on such low incomes do not have a disposable income in any case. If their low levels of income necessitate a hand-to-mouth existence, should longer-term thinking and financial planning be encouraged? Increasing income should be the priority.

Research from a similar scheme in America shows that people on low incomes can, and perhaps more importantly want to, save small amounts on a regular basis. For many people the Saving Gateway replaces an existing informal form of saving (the jam jar for instance). The saving scheme offers a decent return on very small savings that people on higher incomes would benefit from through tiered interest rates and tax breaks. Why should poor people not reap as comparable rewards for saving as people on higher incomes?

A balanced view needs to be taken on asset-based welfare policy: it is not a case of either income or assets, but of both income and assets. For those people who want it, there should be the opportunity of saving and reaping clear benefits. If the aim is to increase financial inclusion, the answer is not to keep people in ignorance, excluded from products that policy makers judge unsuitable. People on low incomes have every right to make the decision for themselves. Policy, therefore, needs to be equally concerned with what informs individuals’ decisions and how education can best be delivered to ensure that all people (whatever their income) are enabled to make the right decision given their circumstances.

Financial education

The five Saving Gateway pilots do not stand alone but, in all but one case, are run alongside a Community Finance and Learning Initiative (CFLI). One of the objectives of the CFLI is to promote financial literacy through the provision of financial education. The National Foundation of Educational Research describes financial literacy as the ‘ability to make informed judgements and to take effective decisions regarding the use and management of money’.

The delivery of financial education can be said to comprise three key themes: building skills, increasing knowledge and developing understanding and within each of these a client’s confidence should also be developed.

Building skills

Literacy and numeracy are fundamental skills in managing money and understanding the plethora of financial products available by which to do so. Research commissioned by the Basic Skills Agency (BSA) [Footnote 8] shows that there is a link between people who have low levels of literacy and numeracy and financial difficulties. Almost one in four people (23 per cent of population) do not have the basic skills expected of an 11-year-old. Moreover, research shows that whilst people with poor basic skills do hold financial products, they are less likely to do so.[Footnote 9] Consequently, the BSA has developed useful resources for delivering financial education to people with basic skills needs [Footnote 10] and worked with four financial institutions to train front-line workers in helping customers with basic skills needs.

Increasing knowledge

Raising awareness and increasing knowledge of financial products is key in helping people make informed decisions. Financial institutions tend not to market very deprived areas, where residents are more likely to already be financially excluded.[Footnote 11] As such, residents of these areas are even less likely to become aware of suitable products as they come onto the market. In terms of promoting financial inclusion, much of the work is simply in providing easily understood information in a safe and engaging environment. To this end the Financial Services Authority has produced a detailed consumer website, various free leaflets and a financial planning CD-Rom [Footnote 12] and these are publicly available through CABs, libraries, post offices and the like. Financial providers and other trusted local community organisations also make excellent vessels for disseminating such information.

Developing understanding

Whilst increasing knowledge is mostly about the provision of information, developing understanding is about giving an individual a strategy for dealing with this information, which might include skills for budgeting, planning, understanding the types of products available and shopping around to find the best deal. There is no definitive way for delivering this type of training but it is generally agreed that, for the client, there has to be ‘something in it for me’. Debt advice, basic skills courses and initiatives like the Saving Gateway can be useful ‘carrots’ for engaging people in financial education and resources like the Adult Financial Capability Framework [Footnote 13] give a sound structure from which to plan the training.

Building confidence

All aspects of training should build an individual’s confidence. The skills and confidence necessary for filling out forms, asking questions, getting further clarification and making complaints in an effective manner are all too often taken for granted. In all aspects of training there needs to be constant affirmation of the individual, the individual’s rights and significance as a citizen in our society (and of their consequent responsibilities towards others). An individual has a right to ask questions and receive answers that make sense to them from a person who is able to see beyond their own needs and react in a positive way.

Basic bank accounts

There is, however, no single solution for financial exclusion and a financially capable adult has little chance of becoming financially included if the environment is set against them. The Government has made significant moves to promote a more accessible environment [Footnote 14] but one initiative is of particular relevance at the time of writing: access to mainstream financial services through the provision of appropriate financial products.

Apart from wishing to promote a socially cohesive society more generally, the Government has a vested interest in advancing financial inclusion and access to mainstream financial services. In 1999 the decision was taken to move all benefits payments from giro to automated credit payments (ACT) by 2003, thus saving the Government (and the tax payer) approximately £650m a year in administration costs and fraud. [Footnote 15] However, this relies upon recipients having some kind of account to which benefits can be credited.

A universal bank was initially proposed. This was to be a no frills banking service available through post offices. Not only would the universal bank promote financial inclusion, but it would also advance benefits reform and modernise post offices. The cost of doing so, however, was considered too great and neither the Government nor the banking industry would pay the bill. Instead the paper-based giro has been replaced by the post office card account (POCA). This allows benefits (not salaries) to be paid by ACT and withdrawn in cash at a post office as before, but otherwise offers very little flexibility. Alongside POCA some 18 financial institutions have so far developed (or committed to develop) a basic bank account. These accounts vary by bank, but are similar to a standard current account without an overdraft facility or cheque book. With no overdraft users do not need to be credit scored nor fear losing control of their money. Customers can set up standing orders and direct debits, use their Solo or Electron card for debit transactions, as well as withdraw cash from cashpoints and their benefits from a post office.

There have, however, been some complaints about the lack of marketing for basic bank accounts and some banks’ hesitancy in embracing the basic bank account target group. The problem is that basic bank accounts are considered unprofitable.

It should not be forgotten that banks and building societies are profit-making institutions with shareholders and that the local branch is similar to any other shop – it is there to sell a product. It is estimated that if all 13 million benefits recipients decided to use standard or basic bank accounts (which is unlikely in the early years, but surely the ultimate aim for the future) then the total costs to the industry could be as high as £1 billion. Incremental costs could be £400-£650 million if each account costs £30-£50 per annum. [Footnote16] Whilst the Government will make considerable savings by transferring benefits payments to ACT, the banking industry, without any financial incentive or government subsidy, will pay considerable costs to support the initiative.

On the other hand, however, it would be somewhat short-sighted to believe there is no business case for the basic bank account. The Government spends several millions of pounds in benefits and tax credits. This could be money flowing straight to financial institutions, which may not always flow straight out. The number of benefit recipients hits millions and it is plausible that a financial institution could expand its client base (and profits) significantly by actively marketing its basic bank account (especially in deprived areas) and later cross-selling products (eg, savings accounts). It is also likely that for some customers a standard account with an overdraft facility will be appropriate and profitable. For many, overdrafts offer a cheap and reliable form of short-term credit which in the longer term some basic bank account clients may graduate towards. Further development to structure the repayments of overdrafts could also increase confidence and a sense of being in control among potential users whilst keeping defaults low. The labour market and income levels are also variants which should be taken into account: today’s single mother with a baby on income support may well be next year’s new business entrepreneur.

A new approach to basic bank accounts and people on benefits needs to be adopted. By non-marketing the basic bank account and by giving staff no financial incentive to sell it [Footnote 17] a negative view of the target group is reinforced both to staff and society more generally. The cultural barrier between the financial institution and the financially excluded simply widens further.

Many banks already embrace corporate social responsibility, make generous donations and send volunteers to local community organisations. The next step is for corporate social responsibility to have an impact on the way banks do business. This is already happening to some degree through community banking programmes (for instance, the Bank of Scotland’s work with the Big Issue to provide basic bank accounts and an appropriate saving scheme [Footnote 18), initiatives like the Saving Gateway and training packages produced by the Basic Skills Agency, but it needs to happen on a much larger scale.

The voluntary sector has a key role to play in promoting initiatives like the Saving Gateway and other community banking programmes, as well as in informing, supporting and being positive about financial institutions’ steps towards financial inclusion. Similarly, some parts of the financial sector need to open their doors more widely, become aware of the neighbourhoods in which they work and promote a more outward-looking, customer-centric model to work alongside their target-based, profit-driven model.

Conclusion

In conclusion, there are many issues (some which are not mentioned above) which need to be taken into account when considering the best course towards financial inclusion. A recent report on poverty [Footnote 19] suggests that there has been little change over the last five years in the number of financially excluded people. There is still a long way to go, but the need for change becomes ever more acute. One of the main characteristics of the work should be that it is collaborative and ‘joined-up’, harnessing the strengths and expertise of all those involved, whether in policy, government, regulation, education, industry or the voluntary sector.

Faith Reynolds is the co-ordinator of SAFE (Services Against Financial Exclusion) at Toynbee Hall in the London Borough of Tower Hamlets

Thanks go to Ian McGimpsey and Luke Geoghegan of Toynbee Hall, and volunteers Sean Williams, Will Paxton and Gill Hind for their help with this article.

http://www.cpag.org.uk/info/Povertyarticles/Poverty114/financial.htm

Financial inclusion index

The importance of financial services in all of our lives has, in recent years, risen significantly. This is a consequence of both a growing and more prosperous United Kingdom economy, and an innovative financial services sector, which has developed ever more ways of meeting the needs of its customers. Exclusion from the financial system brings with it, therefore, real and rising costs, often borne by those who can least afford them, which is why promoting financial inclusion has been, and continues to be, a key priority for the Government.

To ensure that as few people as possible have to bear these costs, the Government has taken responsibility for developing a strategic policy response, working with key stakeholders from the financial services industry, the third sector, and elsewhere. The Government’s key goals for financial inclusion are about ensuring that everyone has access to appropriate financial services, enabling them to:

- manage their money on a day-to-day basis,effectively, securely and confidently;

- plan for the future and cope with financial pressure, by managing their finances to protect against short-term variations in income and expenditure, and to take advantage of longer-term opportunities; and

- deal effectively with financial distress,should unexpected events lead to serious financial difficulty.

The Government’s action plan for financial inclusion, Financial inclusion: an action plan for 2008-11, sets out in detail how the Government will use the £130 million Financial Inclusion Fund, announced in the CSR, to achieve its financial inclusion objectives over the next three-year spending period from April 2008 to March 2011.

Financial Inclusion - the way forward

This action plan builds on Financial Inclusion - the way forward, which sets out the policy framework for financial inclusion in 2008-11, including:

- a new Financial Inclusion Fund for 2008-11;

- an extension to the Financial Inclusion Taskforce until March 2011, so that it can continue to monitor and evaluate progress and advise the Government on financial inclusion developments; and

- a ministerial working group chaired by the Economic Secretary to the Treasury, with members from the Department for Work and Pensions, the Department for Business, Enterprise and Regulatory Reform, the Department for Communities and Local Government, the Cabinet Office and the Ministry of Justice to develop an action plan for financial inclusion in 2008-11.

Promoting Financial Inclusion

The Government's first financial inclusion strategy, Promoting financial inclusion, was published in December 2004. This:

- announced the creation of a dedicated Financial Inclusion Fund of £120 million for the 2005-08 spending period;

- announced a goal, shared between Government and the banks, to halve the number of adults living in households without access to a bank account, and to make significant progress within two years – recently announced that 60 per cent of the progress required to achieve the shared goal had been made; and

- established an independent Financial Inclusion Taskforce to advise the Government and monitor progress.

-

What is 'Financial Inclusion' ?

"Financial inclusion is delivery of banking services at an affordable cost ('no frills' accounts,) to the vast sections of disadvantaged and low income group. Unrestrained access to public goods and services is the sine qua non of an open and efficient society. As banking services are in the nature of public good, it is essential that availability of banking and payment services to the entire population without discrimination is the prime objective of the public policy."

-

-

The banking industry has shown tremendous growth in volume and complexity during the last few decades.

-

Despite making significant improvements in all the areas relating to financial viability, profitability and competitiveness, there are concerns that banks have not been able to reach and bring vast segment of the population, especially the underprivileged sections of the society, into the fold of basic banking services.

-

Internationally also efforts are being made to study the causes of financial exclusion and design strategies to ensure financial inclusion of the poor and disadvantaged.

- The reasons may vary from country to country and so also the strategy but all out efforts are needed as financial inclusion can truly lift the standard of life of the poor and the disadvantaged.

-

When bankers do not give the desired attention to certain areas, the regulators have to step in to remedy the situation. This is the reason why the Reserve Bank of India places a lot of emphasis on financial inclusion.

-

With a view to enhancing the financial inclusion, as a proactive measure, the RBI in its Annual Policy Statement of the year 2005-2006, while recognizing the concerns in regard to the banking practices that tend to exclude rather than attract vast sections of population, urged banks to review their existing practices to align them with the objective of financial inclusion.

- No-Frills' Account :

-

In the Mid Term Review of the Policy (2005-06), RBI exhorted the banks, with a view to achieving greater financial inclusion, to make available a basic banking 'no frills' account either with 'NIL' or very minimum balances as well as charges that would make such accounts accessible to vast sections of the population. The nature and number of transactions in such accounts would be restricted and made known to customers in advance in a transparent manner. All banks are urged to give wide publicity to the facility of such 'no frills' account, so as to ensure greater financial inclusion.

-

- 'Simplification of 'Know Your Customer (KYC)' Norms :

-

Banks are required to provide a choice of a 'no frills account' where the minimum balance is nil or very small but having restrictions on number of withdrawals, etc., to facilitate easy access to bank accounts.

-

Further, in order to ensure that persons belonging to low income group both in urban and rural areas do not face difficulty in opening the bank accounts due to the procedural hassles, the 'KYC' procedure for opening accounts for those persons who intend to keep balances not exceeding rupees fifty thousand (Rs. 50,000/-) in all their accounts taken together and the total credit in all the accounts taken together is not expected to exceed rupees one lakh (Rs. 1,00,000/-) in a year has been simplified to enable those belonging to low income groups without documents of identity and proof of residence to open banks accounts. In such cases banks can take introduction from an account holder on whom full KYC procedure has been completed and has had satisfactory transactions with the bank for at least six months. Photograph of the customer who proposes to open the account and his address need to be certified by the introducer.

-

- Ensuring reasonableness of bank charges :

-

As the Reserve Bank has been receiving several representations from public about unreasonable service charges being levied by banks, the existing institutional mechanism in this regard is not adequate. Accordingly, and in order to ensure fair practices in banking services, the RBI has issued instructions to banks making it obligatory for them to display and continue to keep updated, in their offices/branches as also in their website, the details of various services charges in a format prescribed by it. The Reserve Bank has also decided to place details relating to service charges of individual banks for the most common services in its website

-

What Is: First Things First

First Things First

First Things First[1] (1994) is a self-help book written by Stephen Covey and A. Roger and Rebecca R. Merrill. It offers a time management approach that, if established as a habit, is supposed to help a person achieve "effectiveness" by aligning him- or herself to "First Things". The approach is a further development of the approach popularized in Covey's The Seven Habits of Highly Effective People and other titles.

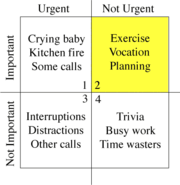

The book asserts that there are three generations of time management: first-generation task lists, second-generation personal organizers with deadlines and third-generation values clarification as incorporated in the Franklin Planner. Using the analogy of "the clock and the compass," the authors assert that identifying primary roles and principles provides a "true north" and reference when deciding what activities are most important, so that decisions are guided not merely by the "clock" of scheduling but by the "compass" of purpose and values. Asserting that people have a need to "to live, to love, to learn, and to leave a legacy" they propose moving beyond "urgency addiction" into what they call "quadrant two" management (not the same as the quadrant II in a Cartesian coordinate system).

In the book, Covey describes a framework for prioritizing work that is aimed at long-term goals, at the expense of tasks that appear to be urgent, but are in fact less important. This is his 2x2 matrix: classifying tasks as urgent and non-urgent on one axis, and important or non-important on the other axis. His quadrant 2 has the items that are non-urgent but important. These are the ones he believes we are likely to neglect; but, should focus on to achieve effectiveness.

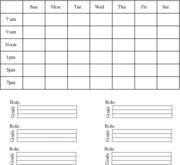

Important items are identified by focusing on a few key priorities and roles which will vary from person to person, then identifying small goals for each role each week, in order to maintain a holistic life balance. One tool for this is a worksheet that lists up to seven key roles, with three weekly goals per role, to be evaluated and scheduled into each week before other appointments occupy all available time with things that seem urgent but are not important. This concept is illustrated with a story that encourages people to "place the big rocks first."

Delegation is presented as an important part of time management. Successful delegation, according to Covey, focuses on results and benchmarks that are to be agreed in advance, rather than on prescribing detailed work plans.

http://en.wikipedia.org/wiki/First_Things_First_(book)

First Things First. To Live. To Love. To Learn. To Leave a Legacy. Sounds like a terrific plan for a rewarding and balanced life. Stephen R. Covey, A. Roger Merrill, and Rebecca R. Merrill have created one of the best books I've read to help us all balance the spiritual, mental, physical, and social elements of our lives.

The book is in four sections:

Section One: The Clock and the Compass

Here the authors discuss time management problems we face in our personal and business lives.

Our struggle to put first thing first can be characterized by the contrast between two powerful tools that direct us: the clock and the compass. The clock represents our commitments, appointments, schedules, goals, activities—what we do with, and how we manage our time. The compass represents our vision, values, principals, mission, conscious, direction—what we feel is important and how we lead our lives.

[page 19]

The section talks about the strengths and weaknesses of various time management strategies.

Some of the main concepts discussed in the section are balancing spiritual, mental, social, and physical needs. Balance is achieved by using personal endowments such as self-awareness, conscience, independent will, and creative imagination to align to "True North" principles (the compass). Various exercises are provided to help you explore these aspects for yourself.

Th first section introduces the following Urgency / Importance quadrant that is used throughout the book as a way of looking at time priorities.

I Urgent - Important

| II Not Urgent - Important

|

III Urgent - Not Important

| IV Not Urgent - Not Important

|

Section Two: The Main Thing Is To Keep The Main Thing The Main Thing

This section introduces Quadrant II Organizing: The Process of Putting First Things First. The key here is identifying what our first things are in relation to our life roles. There is a lot in this section, but perhaps the following discussion of roles provides a good sample:

Our Natural Roles Grow Out of Our Mission

Where do we get our roles? If we haven't paid the price to work them out in our deep inner life, they're probably a combination of feelings we have about ourselves and the social mirror.

But if we have paid the price, our roles are like the branches of a living tree. They grow naturally out of a common trunk—our mission, the unique fulfillment of our needs and capacities—and common roots—the principals that give sustenance and life. Our roles become the channels through which we live, love, learn, and leave a legacy.

[pages 124-5]

Again, the section is filled with discussions and exercises to help you identify your mission, principles, and roles.

Section Three: The Synergy Of Interdependence

This section explores personal missions in the context of other people. This involves developing shared visions with in organizations and developing win-win relationships in personal, professional, and business life.

The Miracle of the Chinese Bamboo Tree

The Chinese bamboo tree is planted after the earth is prepared, and for the first four years, all the growth is underground. The only thing visible above the ground is a little bulb and a small shoot coming out of it.

Then, in the fifth year, the bamboo tree grows up to eighty feet.

Principal-centered leaders understand the metaphor of the bamboo tree. They understand the value of working in Quadrant II. They know what it means to pay the price to prepare the ground, to plant the seed, and to fertilize and cultivate and water and weed, even when they can't see immediate results, because they have faith that ultimately they will reap the fruits of the harvest.

And what wonderful fruits they are!

Your organization's culture is the one competitive advantage that cannot be duplicated. Technology can be copied. Information can be acquired. Capital can be bought. But the ability of your organization to collaborate effectively, to work in Quadrant II, to put first things first, cannot be bought, transferred, or installed. A high-trust, empowered culture is always home grown.

The same is true for a family, or any other group of people. A quality culture must be nourished over time. Only by acting in harmony with correct principles, exercising patience, humility, and courage, and working within your Circle of Influence can you transform yourself and positively influence your organization. You can only create empowerment from the inside out.

[Pages 265-6]

Section Four: The Power and Peace of Principle-Centered Living

The final section talks about moving from time management to personal leadership and leaves us with the following question:

Is there something I feel I could do to make a difference?

Think about it. It may require a letting go—of illusory paradigms, rationalizing, wants, urgency addiction . . . even your comfort zone. But deep down, in all honesty of heart, do you feel there's something you could do, some contribution you could make, some legacy you could leave that would impact your family, your work team, your organization, your community, your society in a positive way?

If there is, we encourage you to act on it. As Ghandi dais, "We must become the change we seek in the World." Whatever you are in terms of becoming principle-centered, we encourage you to start exercising the attributes of your heart. Make a promise and keep it. Set a goal and achieve it. There is peace in it. As Emerson said:

Nothing can bring you peace but yourself. Nothing can bring you peace but the triumph of principles.

http://www.shared-visions.com/explore/literature/firstthings.htm